As affordable housing costs continue to rise nationwide, understanding the forces that quietly inflate prices has never been more essential.

This three-part series, written by Principal Architect Patrick Chopson, AIA, breaks down the complex regulatory systems that shape what Americans ultimately pay for a home.

Across the nation’s 10 largest metros, Chopson examines the true “regulatory tax” on housing: the permits, impact fees, mandated consultants, approval delays, and code changes that now consume up to 40% of total development costs.

These hidden burdens transform a $240,000–$440,000 construction budget into a far higher final price, adding anywhere from $3,400 to $128,000 per home and pushing millions of families out of reach.

Part One establishes the national landscape and the key cost drivers; Parts Two and Three dig deeper into metro-level disparities and the policy reforms that could finally make housing more affordable.

How Affordable Housing Regulations Add Up to 40% to Costs

Regulatory costs now consume up to 40% of housing development expenses across America's largest metros, with a single permit approval process varying from 8 days to nearly a year depending on jurisdiction.

This analysis of the top 10 metropolitan areas reveals that while a 2,000-square-foot home costs $240,000-$440,000 to physically construct, regulatory expenses (from permits and impact fees to mandated consultants and approval delays) add between $3,400 and $128,000 to the final price tag.

These costs directly price out millions of American families from homeownership and make rental housing increasingly unaffordable, yet the variation between efficient and burdensome jurisdictions proves that much of this regulatory burden is policy choice rather than necessity.

The Regulatory Tax on American Affordable Housing

Government regulations at all levels now represent the second-largest cost component in new housing construction, exceeded only by the physical materials and labor. National data shows regulatory costs averaged $93,870 per single-family home in 2021, a staggering 44% increase from $65,224 just a decade earlier. For multifamily developments, regulations consume 40.6% of total development costs, with building code changes alone accounting for 11.1% of the final price.

Single-Family Approval Timelines

Multi-Family Approval Timelines

These costs manifest across three distinct phases. During the development phase, impact fees, zoning approval processes, and mandated studies add an average of $41,330 per single-family home. The construction phase brings building permit fees, plan reviews, and code compliance requirements totaling another $52,540. Woven throughout both phases are time delays (the silent killer of housing affordability) as each month of approval delays compounds carrying costs on land and construction financing.

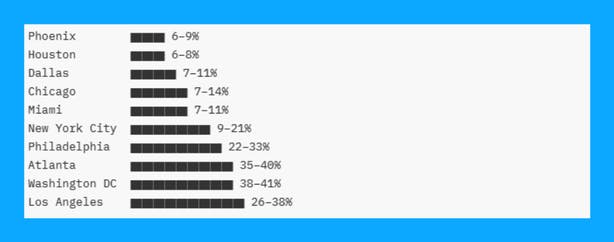

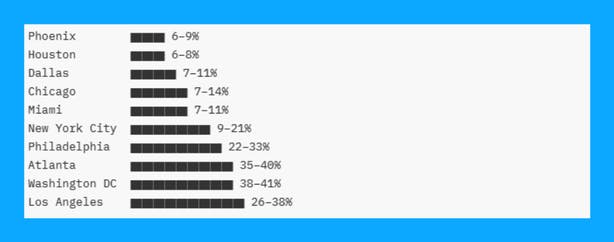

Single-Family Regulatory Cost (% of Construction)

Low → High range visualized for each metro

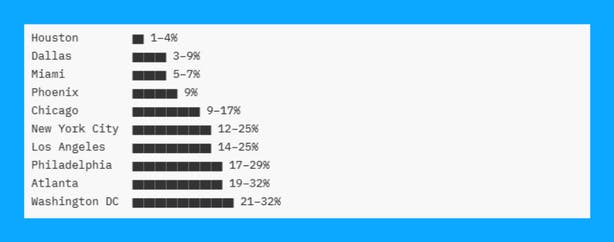

Multi-Family Regulatory Cost (% of Construction)

Low → High range visualized for each metro

The geographic variation in regulatory burden reveals these costs are largely discretionary rather than inevitable. Houston requires 1-2 weeks for residential permit approval and imposes minimal regulatory costs beyond water impact fees. Los Angeles demands 16-25 months for discretionary multifamily projects and layers on $960,000 in affordable housing linkage fees for a 100-unit development. Both cities build housing successfully, yet one regulatory regime costs roughly ten times more than the other in both time and money.

What Drives Affordable Housing Regulatory Costs

Building code changes implemented over the past decade comprise the single largest regulatory cost component at 11.1% of multifamily development costs nationally, according to the National Association of Home Builders. These codes, covering energy efficiency, fire safety, accessibility, and structural standards, added $24,414 to the average single-family home by 2021. While safety codes provide genuine value, the National Association of Home Builders (NAHB) found that 84.5% of builders face design standards beyond what they would ordinarily implement, and 90.2% report building codes have added costs over the past decade.

Impact fees represent the most visible and variable cost component. These one-time charges (assessed for transportation, schools, parks, water, sewer, fire, police, and other infrastructure) theoretically fund the public costs of new development.

In practice, they vary from $0 in some Houston developments to $17,765 per single-family home in Phoenix's high-infrastructure zones to $960,000 for multifamily projects in Los Angeles. Maricopa County, Arizona, charges $11,076 per 2,000-square-foot home; Miami-Dade assesses fees across seven separate categories totaling $7,200-$10,300; Dallas suburbs impose $6,000-$15,000. The variation suggests these fees often exceed actual infrastructure costs and function as general revenue sources or growth-limiting tools.

Time delays convert directly into carrying costs through construction loan interest, property taxes, insurance, and opportunity costs. A typical construction loan charges 7.65% interest on 75% of project costs, with a 1-point origination fee.

For a $2 million multifamily land parcel, each month of delay costs approximately $11,500 in interest alone. Atlanta city's 40-week approval timeline versus suburban counties' 4-week timeline imposes a 36-week penalty worth $20,000-$40,000 per single-family home. Philadelphia's 8-month stormwater review adds similar carrying costs. Houston's 1-2 week residential approval versus Los Angeles's 16-25 month discretionary multifamily timeline creates a cost differential of hundreds of thousands of dollars through delay alone.

Professional and consultant fees required by regulation add substantially to development costs. New York City mandates licensed architects or professional engineers for all permits, costing $15,000-$30,000 for single-family homes and $800,000-$1.6 million for 100-unit multifamily projects. Washington DC's architectural fees reach 12-18.8% of construction costs, the highest rate documented in this analysis.

Beyond architects, regulations mandate structural engineers, MEP (Mechanical, Electrical, Plumbing) engineers, geotechnical studies, traffic studies, environmental reports, Title 24 energy compliance, CEQR reviews in New York, CEQA compliance in California, and hurricane engineering in Florida. For a 100-unit multifamily development, these consultant fees total $1.4 million to $3.7 million depending on jurisdiction.

The zoning and entitlement process itself imposes costs through application fees, legal representation, community engagement, and multiple review cycles. New York's ULURP process costs $150,000-$400,000 in application and review fees alone, with legal and consulting adding another $200,000-$500,000. Los Angeles entitlement processes run $400,000-$1.1 million.

Even straightforward zoning reviews involve costs: Philadelphia charges for preliminary reviews, design review complexity surcharges, and public hearing notifications. The NAHB found 74.5% of multifamily developers encounter NIMBY (Not In My Back Yard) opposition, which adds an average 5.6% to development costs and 7.4 months to timelines.

Streamlined Processes Show Affordable Housing Regulation Alternatives Exist

The dramatic variation in regulatory costs and timelines proves that heavy burdens are policy choices rather than construction necessities. Several jurisdictions have implemented reforms demonstrating faster, cheaper approval processes can work at scale.

Sunnyvale, California

Pioneered the One-Stop Permit Center model in 1985

→ Co-locates staff from Community Development, Public Works, and Public Safety.

→ Enables 90% of building permits to be issued at the counter during the initial visit.

→ Provides same-day approval, eliminating weeks or months of delay and carrying costs.

→ Model replicated nationwide, showing efficiency is possible even in California’s regulatory environment.

Chicago, Illinois

Offers multiple permitting tracks based on project complexity and builder experience:

→ Self-Certification Program: approval in 10 days for qualifying builders.

→ Easy Permit Program: same-day approval for straightforward projects.

→ Developer Services Track: handles complex developments with dedicated support.Standard plan review averages 70 days—faster than most coastal competitors.

Demonstrates that tier-based systems can reward builder competence with faster approvals while maintaining oversight of complex projects.

Houston, Texas

Combines minimal zoning requirements with efficient permitting processes.

Typical timelines:

→ Residential: 5 - 10 business days

→ Commercial: 4 - 8 weeksThese faster timelines save developers tens of thousands in carrying costs compared to jurisdictions with 6 - 18 month processes.

Lack of discretionary zoning reviews eliminates opportunities for NIMBY delays.

Despite water/wastewater impact fees, the speed and predictability provide a competitive advantage—contributing to rapid housing growth and relative affordability.

Los Angeles, California

Executive Directive 1 (Mayor Karen Bass): ministerial review of qualifying affordable housing projects within 60 days.

Bypasses discretionary public hearings.

Has approved thousands of additional affordable units that would otherwise face 16–25 month timelines.

Demonstrates that strong political will can dramatically compress approval timelines without sacrificing safety or quality.

Washington State

Passed SB 5290 (2023) creating accountability for permit delays.

→ Cities failing to meet timelines must refund part of permit fees.

→ Provides grants to support transition from paper to digital systems.Addresses the average 6.5-month permit delay costing ~$31,375 in holding costs per project.

Introduces financial consequences to incentivize process improvement.

Phoenix, Arizona

Administrative approval reform under Arizona SB 1103 (2023):

→ Allows staff (not City Council) to approve plats, site plans, and land divisions for qualifying projects.

→ Saves ~30 days and reduces political uncertainty.Express Pass Program: site plan approval in 3 business days for pre-qualified projects meeting objective standards.

Shows that reducing discretionary/political review can substantially accelerate approvals.

Atlanta vs. Surrounding Counties

Atlanta City: ~40-week permit timelines.

Gwinnett, Cobb, Clayton Counties: ~4-week permits.

Efficient counties:

→ Consolidated inspector functions (one qualified inspector vs. four specialists).

→ Maintained in-person service during COVID.

→ Exceeded pre-pandemic permit issuance.Atlanta’s multi-agency process created months of delay.

The 36-week difference translates into $20,000–$40,000 per home in reduced carrying costs = direct evidence of affordability gains from streamlined processes.

The path forward requires recognizing that every $10,000 in regulatory costs, every month of approval delay, and every discretionary review opportunity represents not just a procedural requirement but a substantive reduction in housing affordability and economic opportunity.

Cities that streamline approval processes, consolidate multi-agency reviews, implement tiered permitting tracks, and hold themselves accountable for timeline performance will deliver more housing, greater affordability, and better economic outcomes for residents. The variation documented in this analysis proves the choice is ours to make.

Regulation is Driving Affordable Housing

The wide swings in fees, timelines, and mandated consultants make one point unmistakably clear: America’s housing crisis is not driven by construction limits but by regulatory structures that vary dramatically from one jurisdiction to the next.

The difference between a two-week approval and a two-year approval (or between $3,000 in fees and $128,000) has nothing to do with safety or engineering requirements and everything to do with policy design.

With the national landscape established, the next step is to examine how these regulatory burdens play out on the ground in the country’s largest metropolitan areas.

What does affordable housing look like across America’s biggest metropolitan cities? Part Two (coming soon) breaks down these costs city by city, revealing the true scale of the disparities—and how regulatory choices shape affordability for millions of Americans.

____________________________________________________________________________________________

About cove’s Principal Architect Patrick Chopson, AIA

Patrick Chopson, AIA, is Co-Founder and Principal of cove, an AI-powered architecture firm transforming how buildings are designed and delivered. A licensed architect with 20+ years of experience, technologist and building scientist, Patrick focuses on the intersection of AI and Architecture.

He previously co-founded the building performance consultancy Pattern r+d and co-authored Build Like It’s the End of the World (Wiley, 2025), a guide to decarbonizing AEC. His work has been featured in Architect Magazine, TechCrunch, and ArchDaily, and he regularly collaborates with developers and industry leaders on next-generation solutions.