If regulation helped create America’s affordable housing crisis, only regulation can help undo it.

We’ve mapped the problem, now it’s time to talk about solutions.

After demonstrating in Parts One and Part Two how regulatory costs and timelines vary dramatically across the country, Part Three brings the analysis home: America’s affordability crisis is, at its core, a regulatory crisis.

As Principal Architect Patrick Chopson, AIA, shows, the impact of regulation goes far beyond added fees or prolonged reviews—it systematically shapes who can afford to live where, how quickly housing can be delivered, and whether projects pencil out at all.

From pricing out millions of potential homeowners to stifling multifamily construction in high-demand metros, regulatory burden has become one of the most powerful forces driving today’s housing shortage.

This section connects the dots between regulation, supply constraints, suppressed mobility, and soaring price-to-income ratios—and outlines the policy changes needed to reverse decades of compounding barriers.

The Affordable Housing Crisis is a Regulatory Crisis

Regulatory costs directly reduce affordable housing multiple channels. The most obvious impact comes through price: adding $93,870 in regulatory costs to a single-family home prices out approximately 14 million American households, according to National Association of Home Builders (NAHB) estimates. Each $1,000 increase in median home price excludes roughly 157,000 additional households from homeownership. These costs have a multiplier effect as financing costs, real estate commissions, and profit margins apply to the regulatory component as well as construction costs, amplifying the initial regulatory burden by 0-30%.

The impact extends beyond direct prices to constrain housing supply itself. A National Multifamily Housing Council (NMHC) and NAHB survey data shows 47.9% of multifamily developers avoid jurisdictions with inclusionary zoning mandates, and 87.5% avoid jurisdictions with rent control.

When regulatory costs and uncertainty make projects financially infeasible, housing simply doesn't get built, particularly in the high-demand coastal metros where regulatory burdens are heaviest. Los Angeles permits took 495-747 days for discretionary multifamily projects; Houston takes 4-8 weeks. Unsurprisingly, Houston added 198,000 residents from 2023-2024 while maintaining relatively affordable housing, while Los Angeles housing costs remain among the nation's highest.

Time delays compound the affordable housing problem beyond their direct carrying costs. In a market where housing demand is growing, every month of delayed project delivery means another month of constrained supply pushing prices higher.

Academic research by Edward Glaeser and Joseph Gyourko documents that housing prices in expensive markets reflect a "regulatory tax" (the gap between market prices and physical construction costs) ranging from 0% in Houston to 20% in Boston, 30% in Los Angeles, and 50%+ in San Francisco and Manhattan. These gaps, which were minimal before the 1970s, have grown as regulatory constraints have tightened.

The distributional effects fall heavily on low- and moderate-income households. High-income families can still afford regulated markets, albeit at premium prices. Low-income households find themselves entirely priced out of opportunity-rich metropolitan areas with good schools, job access, and amenities.

Middle-income families face impossible choices: accept long commutes from affordable distant suburbs, dedicate 40%+ of income to housing costs, or leave high-productivity metros entirely.

Research by Harvard economists shows that pre-1980, Americans experienced strong income convergence as low-skilled workers moved to high-wage metros. Post-1980, as regulations tightened in coastal metros, this convergence largely stopped, regulation now prevents workers from moving to their highest-productivity locations, reducing economic mobility and national GDP.

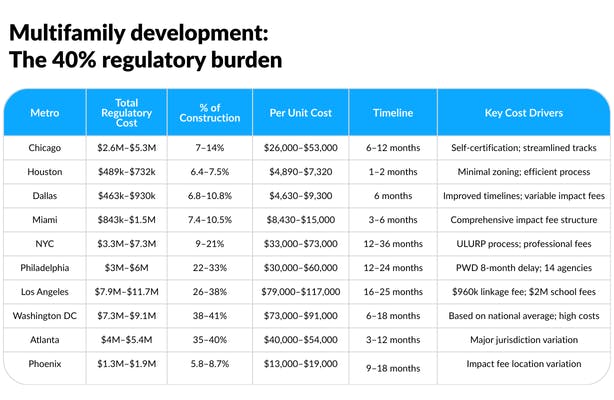

Rental housing faces particularly acute regulatory impacts. The NAHB-NMHC study documenting 40.6% regulatory burden on multifamily development translates directly into higher rents, as developers must recover these costs through rental income.

Inclusionary zoning mandates, intended to create affordable units, actually raise market-rate rents by an average 7.6% according to developer surveys. Rent control, meant to protect tenants, causes 87.5% of developers to avoid those markets entirely reducing rental supply and ironically driving rents higher.

Los Angeles's $960,000 Affordable Housing Linkage Fee for a 100-unit project translates into roughly $9,600 per unit costs that must be absorbed through higher rents on market-rate units or reduced developer returns that make marginal projects infeasible.

The affordability crisis manifests most severely in the jurisdictions with the heaviest regulatory burdens. Manhattan condominiums cost 2-3 times physical construction costs, with the gap representing pure regulatory constraint. San Francisco median home prices reach 9-10 times median household income versus a historical norm of 2.5-3 times. Los Angeles, San Diego, and Washington D.C. all show price-to-income ratios above 7-8x. Meanwhile, Houston, Dallas, and Atlanta (in suburban counties) maintain ratios of 3-4x despite rapid growth—suggesting that regulatory burden rather than growth or construction costs drives unaffordability in expensive markets.

National housing affordability has deteriorated dramatically since 1980, with the median home price rising from 2.5 times median household income to 4.4 times by 2023—a 76% increase in the affordability burden. While mortgage rates were higher in the 1980s (peaking at 18.6% in 1981), home prices were far more reasonable relative to incomes. Today's 7% mortgage rates combine with 4.4x price-to-income ratios to create unprecedented barriers to homeownership. Real housing prices have increased 326% since 1980, compared to overall CPI growth of 207%, with regulatory costs accounting for much of the differential.

Policy Recommendations: Toward Affordable Housing Abundance

The evidence compiled in this analysis points toward several policy interventions that could substantially reduce regulatory burdens while maintaining legitimate safety, environmental, and community standards.

Mandate Timeline Accountability with Financial Consequences

Following Washington State's SB 5290 model, jurisdictions should face fee refunds when permit reviews exceed established timelines. Chicago's 70-day average proves that cities can maintain this standard; Philadelphia's 8-month stormwater reviews demonstrate how single-agency bottlenecks can destroy overall efficiency. Clear timelines with enforcement mechanisms create institutional pressure for continuous process improvement.

Implement Tiered Approval Tracks Based on Project Risk and Builder Experience

Chicago's Self-Certification, Easy Permit, and standard review tracks match oversight intensity to project complexity. Sunnyvale's 90% counter-approval rate for standard permits eliminates unnecessary delays while maintaining review capacity for novel or complex projects. By-right ministerial approval for projects meeting objective standards (as implemented in Los Angeles's Executive Directive 1) removes discretionary review opportunities that enable NIMBY opposition to delay projects indefinitely.

Reform Impact Fees to Reflect Actual Infrastructure Costs Rather Than Function as Revenue Sources

The variation from $0 to $17,765 for identical single-family homes, and $361,800 to $960,000 for 100-unit multifamily projects, suggests these fees often exceed genuine infrastructure needs. Impact fees should be transparent, based on rigorous fiscal impact analyses, and capped at levels that don't render development financially infeasible. Miami-Dade's school impact fees of $2,448 (one-third the rate in neighboring counties) demonstrate that some jurisdictions deliberately undercharge, while Los Angeles's $960,000 linkage fee likely overcharges. Both approaches distort development patterns.

Consolidate Multi-Agency Review Processes Through One-Stop Permit Centers

Philadelphia's requirement for up to 14 agencies to process a single permit, and Atlanta city's navigation of 11 municipal agencies, create coordination nightmares and unpredictable timelines. Sunnyvale's co-located staff, DeKalb County's new one-stop office (opened July 2021), and consolidated review processes eliminate handoff delays and allow applicants to address all agency concerns simultaneously rather than sequentially.

Digitize Permitting Systems to Enable Online Submission, Review, and Tracking

Chicago's e-plan system and Phoenix's online portals provide transparency and reduce in-person queuing time. Washington State's grants to help cities transition from paper to digital recognize that technology investments pay dividends through faster processing and reduced administrative costs. Digital systems also create data that enables performance measurement and continuous improvement.

Reduce or Eliminate Minimum Parking Requirements That Add $36,000-$104,000 Per Unit

Terner Center research documents that structured parking adds $36,000 per unit, with each parking space adding 12.5% to urban development costs. Los Angeles parking requirements cost $104,000 per apartment. In transit-rich areas, mandating parking that residents don't need or use wastes construction resources and increases rents. Parking should be driven by market demand rather than regulatory minimums.

Rationalize Building Code Requirements to Focus on Genuine Safety Improvements

While building codes serve essential safety functions, the NAHB finding that codes added $24,414 to single-family homes and 11.1% to multifamily costs over just one decade suggests diminishing returns. Energy codes, accessibility standards, fire safety requirements, and structural provisions should undergo rigorous cost-benefit analysis. Washington State builders reported energy code increases alone added $13,800-$29,000 per home, costs that must be weighed against actual energy savings and climate benefits.

Preempt Local Regulations That Significantly Constrain Housing Supply

State-level intervention can override municipal regulations that serve primarily to exclude growth and protect incumbent property values. California's accessory dwelling unit (ADU) preemption enabled tens of thousands of new housing units by overriding local prohibitions. Arizona's SB 1103 authorization of administrative approval removed City Council discretion that often enabled political opposition to delay projects. Minimum lot size requirements above one acre, density limits below market demand, and aesthetic review boards that impose expensive design mandates could be limited through state action.

Establish Fast-Track Review for Affordable and Workforce Housing

Los Angeles's 60-day ministerial review for affordable projects, San Diego's Expedite Program for projects with 10%+ affordable units, and Denver's 90-day turnaround goal for affordable housing recognize that regulatory delay costs accumulate identically for affordable and market-rate projects. Affordable developers typically have thinner margins and less capacity to absorb lengthy approval processes, making expedited review particularly valuable.

Create Administrative Approval Authority for Projects Meeting Objective Standards

When projects comply with all zoning, building code, and design requirements, approval should be ministerial rather than discretionary. Pattern books with pre-approved designs, as used in Kalamazoo and other jurisdictions, enable counter approval while maintaining community character standards. Objective standards (maximum height, setbacks, density, parking) can be enforced without discretionary review that invites political opposition and creates unpredictable timelines.

Regulation Burdens American Affordable Housing

The $100,000+ regulatory burden on American affordable housing is not inevitable. Houston proves that major cities can approve permits in weeks rather than months. Chicago demonstrates that dense urban environments can maintain 70-day timelines while coastal competitors require 500+ days. The 36-week gap between Atlanta city and efficient suburban counties shows that regulatory burden is policy choice.

This analysis documents regulatory costs ranging from 1.2% to 41% of construction costs across America's largest metros, a 34-fold variation that cannot be explained by genuine differences in construction complexity, seismic requirements, or climate factors. Los Angeles imposes $960,000 in affordable housing linkage fees on 100-unit projects while Houston builds equivalent projects for $489,000 in total regulatory costs. Philadelphia's Water Department takes 8 months for stormwater review while Houston processes entire projects in similar timeframes.

The cumulative impact extends far beyond dollars and timelines to fundamentally reshape American economic geography. Regulatory constraints in high-productivity coastal metros prevent workers from accessing the best job opportunities, reduce national economic output, and perpetuate income inequality. The housing affordability crisis—with price-to-income ratios increasing 76% since 1980—stems substantially from regulatory costs that have grown 44% in just the past decade. Fourteen million American households find themselves priced out of homeownership by regulatory burdens alone.

Yet the existence of efficient alternatives proves that reform is possible. Sunnyvale issues 90% of permits at the counter. Chicago's self-certification provides 10-day approval. Houston maintains 1-2 week residential timelines. Washington State mandates fee refunds for excessive delays. These jurisdictions still maintain building codes, safety standards, and quality construction—they simply chose to prioritize housing production alongside regulation rather than allow process to become the barrier.

The final takeaway is unmistakable: the $100,000+ regulatory burden weighing down American affordable housing is neither natural nor necessary.

It is the product of policy decisions that can just as easily be reversed. Cities like Houston, Chicago, and Sunnyvale prove that fast, predictable, safety-focused permitting systems are achievable, while Los Angeles, Washington D.C., and Philadelphia demonstrate the cost of allowing process to overwhelm production. The 34-fold variation in regulatory costs documented across major metros distorts where Americans can live, limits access to economic opportunity and drives price-to-income ratios to historic highs.

Yet the reforms highlighted in this analysis: timeline accountability, tiered permitting, preemption, digital systems, fee rationalization, and expedited pathways for affordable housing offer a clear blueprint for restoring housing abundance.

The facts are now unmistakable: the path to affordability runs through regulatory reform, and the cities willing to embrace it will shape the next chapter of America’s housing future.